Refinancing a property security loan will be smart, but it is not necessarily just the right choice for folk. Before carefully deciding, consider your financial predicament therefore the current market. Below are a few factors to consider:

Refinancing might not sound right if you are planning to go within the a couple of years just like the discounts out of a lowered interest might not provide more benefits than the upfront refinancing will cost you.

Are you willing to afford settlement costs?

Refinancing usually comes with costs such settlement costs, that will be big. If these initial will cost you filters your money, refinancing is almost certainly not worth every penny, even if the new loan also offers greatest conditions.

Is your credit score strong enough in order to be eligible for better costs?

Loan providers legs interest levels into a beneficial borrower’s credit rating. When your score possess dropped because you grabbed your brand new mortgage, you will possibly not be eligible for most useful cost, while making refinancing less enticing.

Often your brand new financing terminology match your economic requirements?

Consider what you desire out-of refinancing – a diminished payment per month, repaying the borrowed funds smaller or borrowing significantly more. Ensure the the latest financing terms align together with your objective cash advance.

What’s the newest housing industry for example?

If home prices towards you features decrease, your property guarantee are lower than after you took aside the borrowed funds. This will apply to your ability so you can refinance otherwise improve the cost and terminology lenders offer.

How exactly to Refinance a property Security Mortgage

Refinancing property guarantee financing need mindful planning. Out of researching lenders in order to closing the latest financing, each step of the process helps ensure a flaccid procedure. Let me reveal an easy publication:

Check your credit history

Your credit rating impacts new prices and you may words your be eligible for. Before refinancing, feedback your credit report and take actions to improve your rating if necessary, like paying present credit card debt or correcting people problems.

Glance at your house equity

Lenders need to know simply how much your residence collateral are. Get an estimate of your residence’s latest well worth, and make certain you’ve paid back an adequate amount of the original loan to help you generate refinancing convenient.

Research lenders and you may mortgage choice

Loan providers provide different pricing and you can termspare now offers out-of multiple loan providers so you’re able to find one that fits your targets, instance straight down interest levels or top cost words.

Assemble required data files

Collect data files such as for instance evidence of earnings, tax returns and you may a home assessment. Being organized suggests loan providers you might be better-waiting and you may boosts recognition.

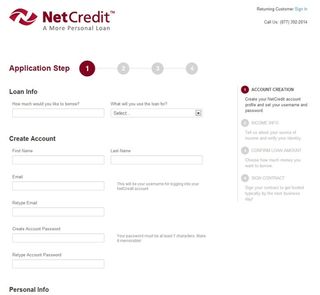

Submit the application

Once reviewing the borrowed funds solutions, submit your application towards the selected lender. Very carefully remark all of the terms and conditions before signing to get rid of surprises later on.

Intimate the loan

Just like the loan is eligible, perform the process because of the signing closure files. Prior to completing the refinance, comprehend the charges and you will this new commission agenda.

What things to Look out for When Refinancing a home Guarantee Financing

Refinancing a home collateral financing even offers flexibility however, boasts risks. Below are a few what you should watch out for ahead of refinancing:

Property foreclosure chance

You reside equity, so shed money into the an excellent refinanced financing can lead to foreclosure. Make sure the the newest financing words try affordable in the long run.

Much more attention over time

Extending your loan term you will lower monthly installments, it could also end up in purchasing even more focus along side longevity of the mortgage. Envision whether brief-identity deals are worth the fresh new a lot of time-identity costs.

Varying rates exposure

For people who re-finance to your a loan with a variable interest rate, your payments you can expect to improve over time as cost increase. Be equipped for possible alterations in monthly installments.

Effect on upcoming credit stamina

Boosting your family security loan you may decrease your capability to acquire up against your residence, limiting selection such as for instance family guarantee lines of credit and other items out of money.

Recent Comments